The Fastest & Easiest Way to Add News to Your Website.

Publish trustworthy, unique business news on your site—curated from across the internet and tailored to your audience.

Why Choose Burstable News™?

Burstable.news™ helps you build audience with fresh, SEO-friendly content—without the overhead of engineering, maintenance, or content creation.

Content Engine

Burstable News™ delivers the latest business news, uniquely formatted and aligned with your brand to keep your site dynamic and engaging.

Super Easy Implementation

No developers needed. As a hosted, platform-agnostic solution, Burstable News™ is quick and easy to add to any website.

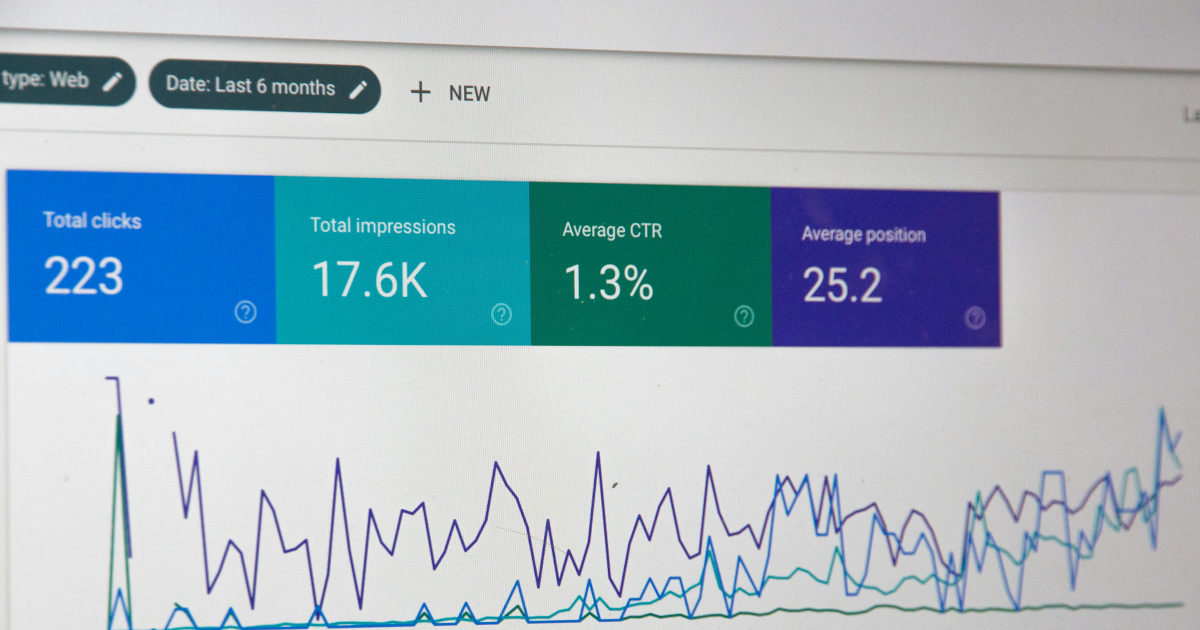

Exceptional SEO

Guaranteed unique content. Boost your site’s authority with vertically aligned stories aligned to your audience. We are Google E-E-A-T all the way.

Ready to Transform Your News Experience?

Join the revolution in business news curation. Get started today with our AI-powered platform.

News Stories Pulled from Leading Newswires

Unique News Content Experiences for Any Website

MAX Power Mining Develops AI-Enhanced Exploration System for Natural Hydrogen Discovery

MAX Power Mining Explores Natural Hydrogen as Solution to AI's Growing Energy Demands

MAX Power Mining Positioned as Natural Hydrogen Pioneer to Meet AI Energy Demands

LaFleur Minerals Positioned to Capitalize on Gold Market Momentum with Swanson Project and Beacon Gold Mill

Foremost Clean Energy Confirms Higher Uranium Grades at Hatchet Lake Property

FWD Group Reports Strong New Business Growth and Strategic Financial Improvements

Cybin Inc. Secures $175 Million in Registered Direct Offering to Advance Neuropsychiatry Pipeline

Bestselling WWII Novel 'Aaron's War' Available Free in Ebook Format November 4-5, 2025

Dayton Insurance Agency Publishes Comprehensive Guide for Ohio HVAC Contractor Insurance Coverage

Omni Insurance Services Launches Multi-State Operation with Rate-Management Focus

The Mall at Wellington Green Launches Veteran-Focused Community Initiatives with Stand Down Partnership

Goldsmith Gallery Jewelers Announces November Events Featuring Robert Procop and Roberto Coin Collections

Milevista Expands Experiential Marketing Services to 19 New U.S. and U.K. Markets

Pennsylvania DUI Defense Attorneys Emphasize Legal Strategies Beyond Plea Deals

IcedJewelz Expands Global Wholesale Program for Eco-Luxury Moissanite Watches

CAHEC Expands Affordable Housing Portfolio with New Louisiana Development

Hong Kong Delegation Strengthens Economic Ties with Saudi Arabia Through Riyadh Mission

Hong Kong Lighting Fairs and Eco Expo Attract 62,000 Global Buyers, Revealing Industry Optimism