ChequesNow Offers Enhanced Security for Canadian Business Cheques

Summary

Full Article

Canadian businesses now have a robust solution for secure financial transactions with ChequesNow's CPA-compliant business cheques. The company has developed laser cheques with sophisticated security measures designed to combat potential fraud and provide companies with peace of mind.

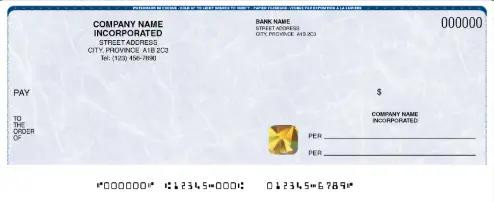

ChequesNow's innovative cheque design includes two primary advanced security features: gold holograms and heat-sensitive ink. The gold holograms are extremely difficult to replicate, serving as a visible deterrent to unauthorized duplication. Heat-sensitive ink changes color with temperature variations, making counterfeiting significantly more challenging.

By adhering to Canadian Payments Association (CPA) regulatory standards, ChequesNow ensures its products meet critical industry compliance requirements. This commitment provides Canadian businesses with cheques that are not only secure but also widely accepted across the financial ecosystem.

Small business owners have already recognized the value of ChequesNow's approach. One manufacturing business owner noted that switching to these cheques has allowed them to focus on growth while feeling confident about their financial transaction security.

The development represents a significant advancement in protecting businesses against financial fraud, offering a specialized solution that addresses the unique security challenges faced by Canadian companies in today's complex financial landscape.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at Press Services

Article Control ID: 43873