IRS Workforce Cuts Threaten Tax Season Efficiency and Taxpayer Support

Summary

Full Article

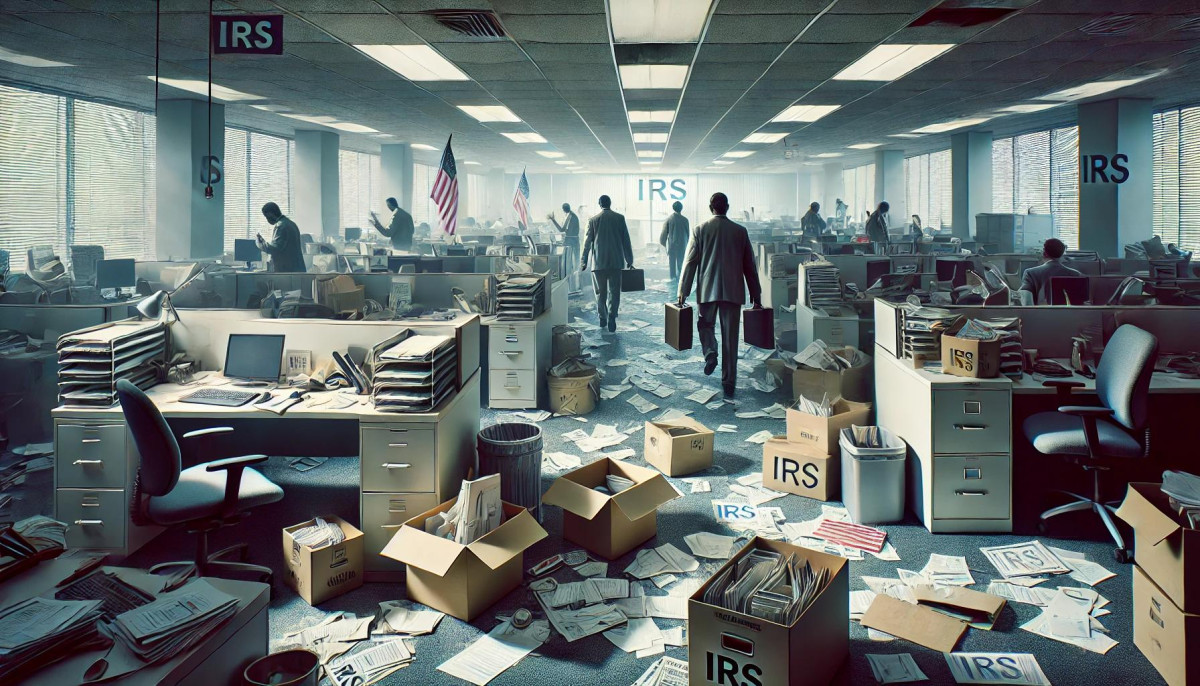

The Internal Revenue Service (IRS) is facing substantial challenges as a 6,000-employee workforce reduction threatens to impede tax season operations. These layoffs, initiated during the Trump administration and reportedly influenced by the Department of Government Efficiency, could dramatically impact taxpayers' experiences with refund processing, audits, and customer support.

The personnel cuts are expected to create significant bottlenecks in several critical areas. Taxpayers may encounter extended wait times for refund processing, potentially disrupting household financial planning. Moreover, the reduced workforce will likely compromise the IRS's ability to conduct timely audits and compliance checks, creating additional uncertainty for individuals and businesses.

Particularly vulnerable are those with complex tax situations, such as individuals facing tax debt or requiring audit support. The diminished staffing means fewer resources for resolving discrepancies, investigating tax issues, and providing customer assistance. This reduction could lead to increased stress and complexity for taxpayers navigating an already intricate tax system.

The implications extend beyond individual inconvenience. Delayed refunds can impact personal economic stability, while reduced audit capabilities might compromise overall tax law enforcement. Taxpayers may need to adopt more proactive strategies, potentially seeking professional guidance to navigate the evolving landscape.

As tax season progresses, individuals should anticipate potential delays and prepare accordingly. Understanding one's rights and exploring available support options will be crucial in mitigating the potential challenges presented by these unprecedented IRS workforce reductions.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at Press Services

Article Control ID: 45854