Brooklyn's Real Estate Market Shows Resilience with $3.25 Billion in Investment Sales in First Half of 2025

Summary

Full Article

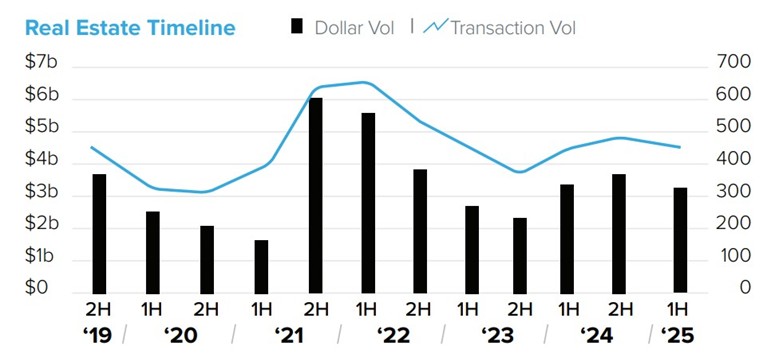

Brooklyn's commercial real estate market has shown remarkable resilience in the first half of 2025, with investment sales totaling $3.25 billion across 453 transactions, according to Ariel Property Advisors' Brooklyn 2025 Mid-Year Commercial Real Estate Trends report. This represents a modest 4% increase in transaction volume and a slight 2% decline in dollar volume compared to the same period in 2024.

Sean R. Kelly, Esq., a partner at Ariel Property Advisors, noted the market's strength despite macroeconomic challenges, with development land values reaching an all-time high of $313 per buildable square foot (BSF). This surge is attributed to pro-housing initiatives such as the City of Yes, signaling strong confidence in Brooklyn's long-term growth and development pipeline.

The multifamily market was a standout sector, with transaction volume up 10% and dollar volume climbing 14% to over $2 billion. Investors are increasingly targeting smaller, free-market buildings to avoid the constraints of rent regulations, with 51.45% of the 282 transactions involving buildings with fewer than 6 units.

Development activity also saw a 5% increase in dollar volume to $610 million, driven by state and local initiatives aimed at addressing the housing shortage. Williamsburg emerged as a leader in development, with 10 sales totaling $72 million, mostly for smaller condo projects.

In contrast, the industrial market experienced a slowdown, with 46 transactions totaling $241 million, marking significant decreases from the previous year. However, the retail sector flourished, with a 16% increase in dollar volume to $188 million, driven by institutional investments in prime locations.

The report underscores the dynamic nature of Brooklyn's real estate market, with strategic shifts in investment focus and robust demand for retail and multifamily properties shaping the borough's economic landscape.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 104402