Pre-Peak Season Shipping Strains Import Volumes Amid Threat of East and Gulf Coast Ports Strike

Summary

Full Article

The July forecast from the ITS Logistics US Port/Rail Ramp Freight Index reveals that pre-retail-peak season shipping activity has led to moderate volume increases across most markets. However, a shortage of equipment at overseas import origins has stressed import volumes, forcing shippers to seek alternative North American entry points outside their usual supply chain networks. Paul Brashier, Vice President of Global Supply Chain for ITS Logistics, noted that while North American inland transportation faces no significant operational challenges, the equipment shortages are causing moderate disruptions, especially in the latter part of July.

Container volumes at the Port of L.A. saw a 14.4% increase, attributed to robust trade activity, early peak season preparations, and concerns over potential labor strikes at East and Gulf Coast ports. The first half of the year processed 4.7 million 20-foot-container equivalent units, surpassing last year's figures for the same period. The looming threat of a labor strike, with the International Longshoremen’s Association's contract expiring in 70 days, has stalled negotiations, raising concerns over potential operational disruptions in the U.S. and Canada.

Brashier emphasized that while a prolonged strike is unlikely, the mere threat is prompting shippers to reroute their shipments to the West Coast to avoid potential delays. This shift, combined with vessels bypassing smaller to medium-volume U.S. ports, is negatively impacting exports. The equipment imbalance is expected to persist as a challenge for exporters into the fourth quarter of the year.

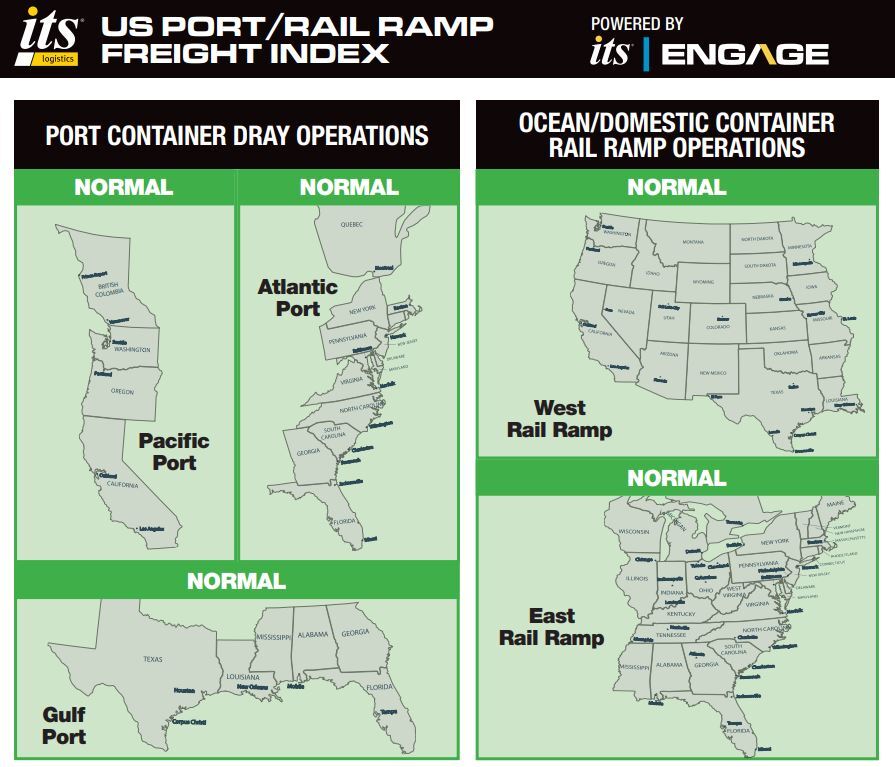

ITS Logistics provides comprehensive network transportation solutions across North America, including drayage and intermodal services in 22 coastal ports and 30 rail ramps, alongside omnichannel distribution and fulfillment services. The ITS Logistics US Port/Rail Ramp Freight Index offers insights into port container and dray operations across the Pacific, Atlantic, and Gulf regions, as well as ocean and domestic container rail ramp operations in the West Inland and East Inland regions. For detailed forecasts and analysis, visit https://www.its4logistics.com.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 113558