ITS Logistics August Index Highlights Export Challenges and Trucker Financial Strain Amid Tariff Negotiations

Summary

Full Article

The ITS Logistics August US Port/Rail Ramp Freight Index indicates export volumes remain constrained as tariff negotiations continue, while inbound volumes to the U.S. West Coast maintain strength. Paul Brashier, Vice President of Global Supply Chain for ITS Logistics, noted that export volumes should surge following trade agreements as shippers address pent-up demand, potentially increasing freight costs, particularly in spot markets. Despite export challenges, inbound volumes remain robust with front-loaded goods and retail peak shipments arriving for fourth-quarter preparation, though terminal congestion and empty container availability issues persist.

Tariff negotiations between the U.S. and China, including a 90-day pause implemented in May 2025, were expected to immediately affect global shipping and transportation markets, causing economic disruption and anticipated rate surges as importers capitalized on temporary tariff reductions. The National Retail Federation’s Global Port Tracker report confirms import cargo volume at major U.S. container ports is forecasted to finish 2025 5.6% below 2024 levels, illustrating the significant impact of current trade policies and existing tariffs on supply chains. These tariffs are raising consumer prices, and reduced imports may lead to fewer goods on shelves, particularly straining small businesses.

Consumer behavior reflects these pressures, with July retail sales excluding automobiles and gasoline increasing 1.45% month-over-month and 5.89% year-over-year as shoppers anticipate future price hikes and potential shortages. The Port of Los Angeles handled 892,340 TEUs in June 2025, an 8% year-over-year increase and its busiest June in 117 years, including 470,459 TEUs of loaded imports (up 10%) and 126,144 TEUs of loaded exports (up 3%). Brashier expects volumes to subside by September except for infrastructure and project freight, which should increase through 2025 into 2026 due to newly passed congressional legislation.

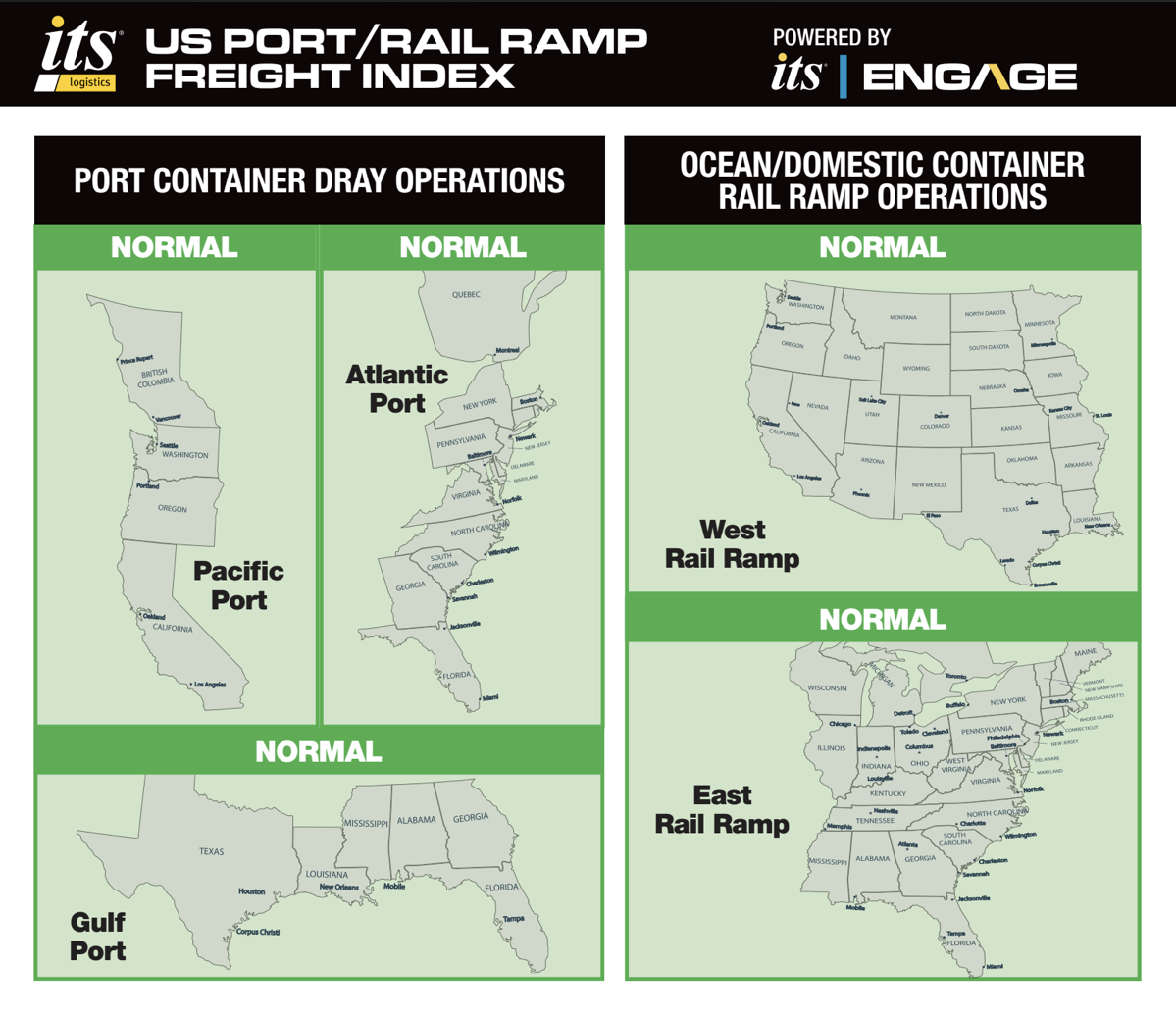

A critical concern highlighted is the financial health of trucking partners, exacerbated by recent closures of major West Coast drayage providers like T.G.S. Logistics and GSC Logistics, which ceased operations after nearly four decades citing market conditions. These closures impact supply chain communities nationwide, especially at the Port of Oakland. ITS Logistics provides comprehensive network transportation and distribution services across North America, including drayage and intermodal operations in 22 coastal ports and 30 rail ramps. The ITS Logistics US Port/Rail Ramp Freight Index offers forecasts for Pacific, Atlantic, and Gulf port container operations and West and East Inland rail ramps, with detailed insights available in their full report.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 168304