Under Armour Faces Profit Halving Due to Tariffs in 2025

Summary

Full Article

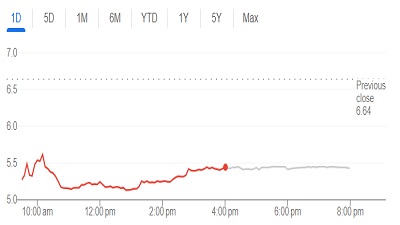

Under Armour, the renowned sportswear manufacturer, has projected a significant downturn in its profitability for the year 2025, attributing this forecast to the adverse effects of trade tariffs. Chief Executive Kevin Plank disclosed to analysts that the company expects its profitability to be halved, a direct consequence of an estimated $100 million in additional costs stemming from these trade levies. This financial strain is compounded by a persistent decline in sales, with revenue dropping 4% in the first quarter to $1.1 billion and a further 6% to 7% decrease anticipated in the second quarter.

In response to these challenges, Under Armour is implementing a dual strategy of price increases and product lineup simplification. This approach is part of a broader initiative to elevate the brand's market positioning to a more premium tier. For instance, the price of its flagship tech T-shirt has risen to $25, with potential further hikes under consideration. Similarly, the company has introduced a $45 hat, significantly pricier than most comparable offerings in the market. These measures aim to counteract the financial pressures from tariffs and restructuring charges, which continue to impact earnings as the company pursues its turnaround plan focused on enhancing operational efficiency.

Despite these hurdles, there are glimpses of progress. The latest quarter saw a 70 basis points improvement in gross margins, driven by a more favorable product mix and disciplined pricing strategies. Neil Saunders of GlobalData observed that while the rate of sales decline has slowed from previous double-digit figures, sales volumes remain over 14% lower than those recorded in 2022. Saunders acknowledged the positive aspects of Under Armour's refined product assortments and higher-quality offerings but highlighted the brand's ongoing struggle to distinguish itself in a saturated market. At certain third-party retailers, Under Armour risks being overshadowed by more fashionable competitors such as Hoka and On, potentially relegating it to the status of a commodity product.

The implications of Under Armour's current predicament extend beyond the company itself, serving as a case study in the broader challenges faced by the sportswear industry amid fluctuating trade policies and consumer preferences. For more information on Under Armour's strategies and market positioning, visit https://www.underarmour.com.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 142254