US Copper Wire Prices Rise Despite Tariff Exemption, Signaling Consumer Cost Concerns

Summary

Full Article

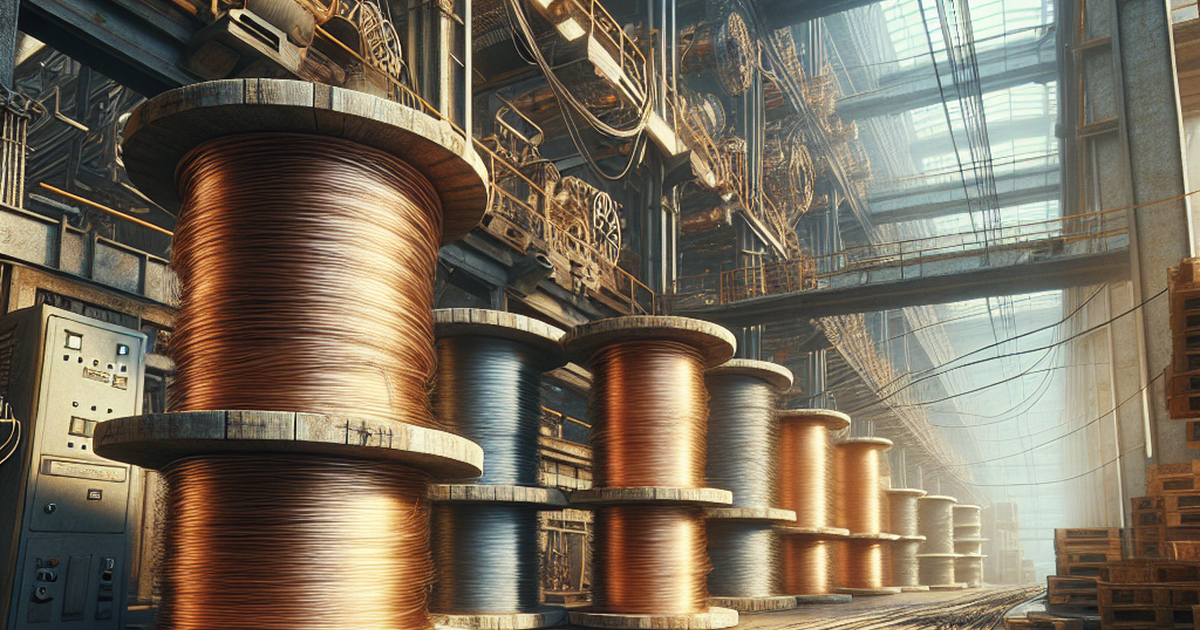

Major electrical wire manufacturers in the United States have begun increasing prices despite President Trump's recent announcement exempting basic copper imports from tariffs. This development occurs alongside a sharp decline in global metal prices, suggesting that American consumers may face higher costs regardless of the tariff reprieve.

The price increases by US copper wire makers indicate potential market complexities beyond tariff considerations. Industry observers, including Canada-based copper companies such as Aston Bay Holdings Ltd., are closely monitoring the tariff situation as it could significantly impact North American copper trade dynamics and pricing structures.

Market analysts suggest that the price hikes may reflect broader supply chain considerations, manufacturing costs, or strategic pricing decisions rather than direct tariff impacts. The situation highlights how multiple factors beyond government trade policies can influence consumer pricing in critical industrial materials.

The latest developments and updates relating to Aston Bay Holdings Ltd. are available in the company's newsroom at https://ibn.fm/ATBHF. MiningNewsWire, a specialized communications platform focusing on global mining and resources sectors, provides comprehensive coverage of such market developments through its network of wire solutions and content distribution channels.

This pricing trend could have significant implications for various industries relying on copper products, including construction, electronics manufacturing, and renewable energy sectors. The disconnect between raw material costs and finished product pricing may signal underlying market pressures or strategic adjustments within the supply chain that could affect end consumers and industrial buyers alike.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at InvestorBrandNetwork (IBN)

Article Control ID: 174936