October Port and Rail Operations Face Regulatory and Economic Pressures

TL;DR

Shippers can gain advantage by vetting carrier financial health and optimizing supply chains to avoid accessorial fees during this regulatory-driven capacity crunch.

The FMCSA emergency ruling restricts non-domiciled CDLs while ports enforce accessorial fees due to declining import volumes, creating a compound market disruption.

Stricter CDL regulations improve road safety standards while pushing the logistics industry toward more sustainable and compliant operational practices for long-term stability.

A nationwide CDL audit revealed non-domiciled drivers account for significant lower-cost capacity, now being removed from the market through regulatory enforcement.

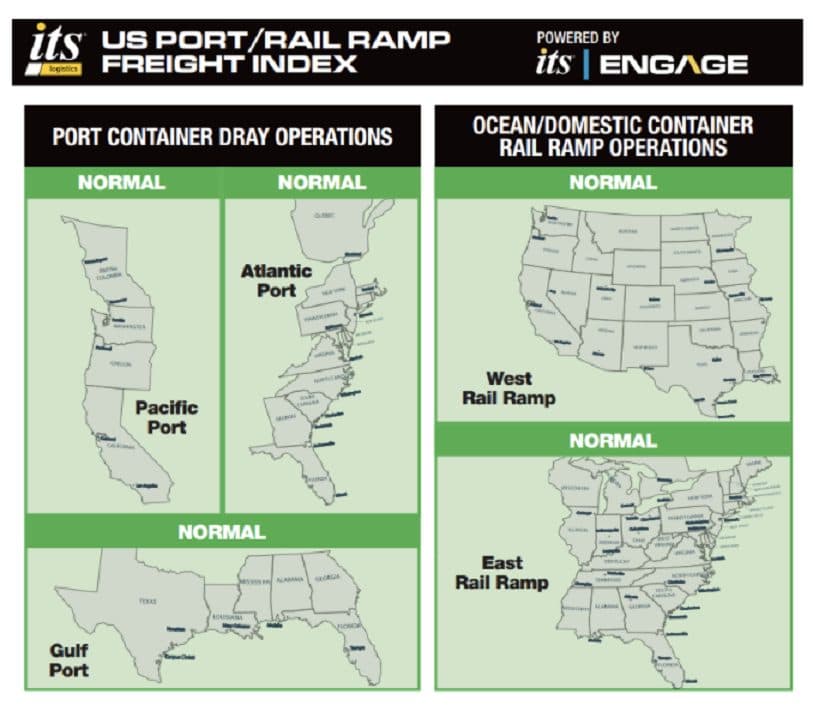

The October ITS Logistics Port/Rail Ramp Freight Index indicates smooth terminal and rail ramp operations despite declining import volumes, while emerging regulatory challenges pose significant threats to future capacity. U.S. September import volume is projected at 2.12 million TEUs, down from 2.28 million TEUs in August and representing a 6.8% year-over-year decrease. The National Retail Federation anticipates that monthly import volumes will continue to drop for the remainder of the year, citing tariffs and frontloading activity in the first half of 2025.

In response to low container demand and declining per-container revenue, ocean carriers are strictly enforcing their accessorial schedules to maintain profitability. This renewed focus on fee enforcement comes as ports seek to capture revenue during what would typically be peak season. With minimal exceptions beyond clear operational failures, shippers are advised to review their supply chains for any inefficiencies that could be exposed and penalized under this stricter enforcement environment.

Beyond port operations, the regulatory landscape is creating additional challenges. Following the review of findings from a nationwide audit of CDL licenses, the Federal Motor Carrier Safety Administration issued an emergency interim ruling restricting eligibility for non-domiciled CDLs on September 26. Several states have since implemented enforcement efforts to verify CDL compliance and English language proficiency at weigh stations, ports of entry, and along major transportation routes.

Industry experts warn that non-domiciled CDL holders account for a significant portion of the lower-cost capacity market, and regulatory crackdowns will likely result in a surge in bankruptcies across small and mid-size carriers. The drayage market has already seen multiple major providers close their doors throughout 2025, and stricter enforcement of non-domiciled CDLs and ELP requirements is expected to exacerbate financial challenges, pushing out capacity and ultimately impacting terminal and port operations upstream.

Paul Brashier, Vice President of Global Supply Chain for ITS Logistics, described these developments as "storm clouds on the horizon that could negatively impact trucking and, by extension, terminal and port operations upstream." He noted that in the near term, these new regulations will remove capacity from the ecosystem and cause market disruption, while in the long term, they could drive many carriers out of business as they struggle to withstand both evolving regulatory pressures and the ongoing freight recession that has pushed rates down to or below operating levels.

The compounding factors of declining import volumes, stricter accessorial fee enforcement, and regulatory pressures on carriers are placing a downward squeeze on an already soft drayage market. This situation creates potential problems for shippers in both the short and long term, particularly as they begin late 2025 and early 2026 RFP activity. Vetting service provider health will become increasingly important as market conditions continue to evolve.

Shippers are advised to take this opportunity to confirm that accessorial dispute processes and documentation requirements are clearly defined in their standard operating procedures. For supply chains utilizing rail for ocean container movement, understanding items like chassis pool flip policies and which parties to engage with to resolve issues within free time becomes crucial for maintaining operational efficiency during this period of increased scrutiny and regulatory change.

Curated from citybiz