MarketWise Receives $17.25 Per Share Buyout Proposal From Monument & Cathedral Holdings

Summary

Full Article

MarketWise received an unsolicited takeover proposal from Monument & Cathedral Holdings LLC to acquire all outstanding shares not already held by the bidder for $17.25 per share in cash. The offer, made through M&C and its affiliates, would include all outstanding equity interests of both MarketWise Inc. and MarketWise LLC. The proposal is contingent on the termination of MarketWise's tax receivable agreement, adding a significant condition to the potential transaction.

The Baltimore-based provider of subscription-based financial research and investor education tools confirmed its board is reviewing the proposal with financial and legal advisers. MarketWise emphasized that the approach may or may not lead to a transaction and stated it does not intend to provide further updates unless it enters a definitive agreement or is otherwise required by U.S. securities laws. This cautious approach reflects the early stage of negotiations and the regulatory considerations involved in such transactions.

Founded in 1999, MarketWise operates a portfolio of investment research and analysis brands that serve self-directed investors seeking market insights, trading strategies, and portfolio tools. The company's properties include well-known financial newsletters and digital platforms catering to both retail and professional audiences. MarketWise generates revenue primarily through paid subscriptions, premium memberships, and software tools that help investors navigate financial markets, with its main platform accessible at https://www.marketwise.com.

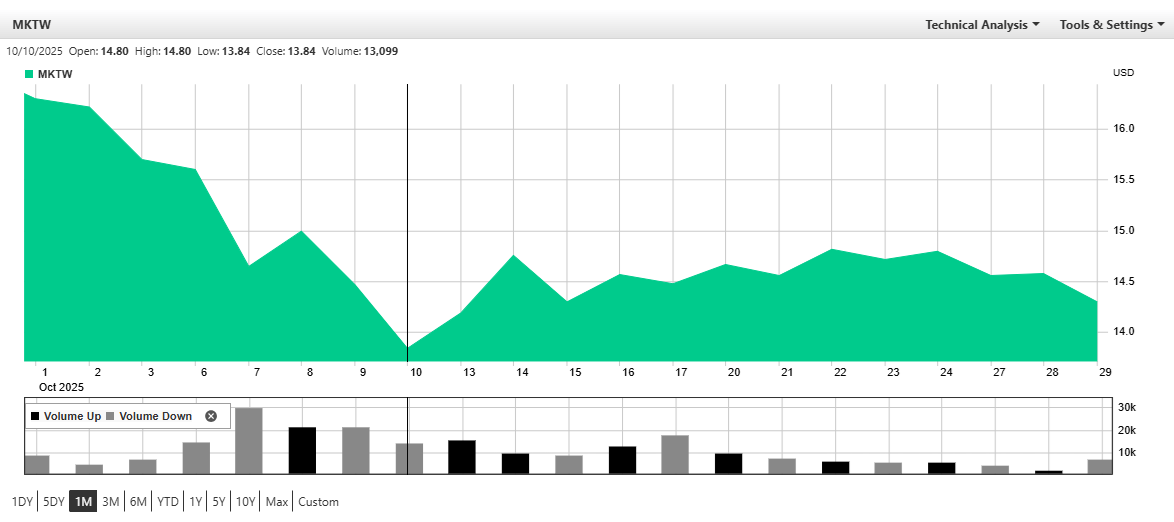

The company went public in 2021 through a merger with a special-purpose acquisition company, marking one of the few digital content firms to list via a SPAC at the time. Since its public debut, MarketWise has focused on expanding its multi-brand platform, deepening customer engagement, and diversifying its offerings beyond newsletters into education and data-driven investment tools. Shares of MarketWise trade on the Nasdaq under the ticker MKTW, with current market performance and historical data available through https://www.nasdaq.com/market-activity/stocks/mktw.

The buyout proposal represents a significant development in the financial research and education sector, where consolidation has been accelerating as larger players seek to acquire specialized content providers and technology platforms. For investors, the $17.25 per share offer provides a potential premium exit opportunity, while for the industry, it signals continued interest in subscription-based financial information services. The outcome of this proposal could influence valuation metrics for similar companies in the digital content and financial technology spaces, particularly those serving the growing self-directed investor market.

MarketWise's diverse portfolio of brands and subscription-based revenue model has positioned it as an attractive target in an era where retail investor participation continues to grow. The company's transition from traditional newsletter publishing to comprehensive digital platforms reflects broader industry trends toward integrated financial tools and educational resources. The proposed acquisition, if completed, would represent one of the larger transactions in the financial media and research sector, potentially setting new benchmarks for how such companies are valued based on their subscriber base, technology assets, and brand recognition.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 269603