Chalet, a data-first platform for short-term rentals, released its year-end analysis of 2025 Airbnb calculator search patterns, revealing emerging markets and cooling former hotspots that offer early signals of shifting short-term rental dynamics heading into 2026. The analysis, based on tens of thousands of searches across 3,080 cities throughout all 50 U.S. states, identified key behavioral trends that provide a directional guide for investment planning.

Florida, California, and Texas comprised 32.5% of all Airbnb searches on Chalet in 2025, reflecting continued Sun Belt dominance in investor interest. This search activity translated directly into execution, with these three states accounting for 69% of the platform's 2025 closed deals. The Sun Belt's appeal carried through from initial research to actual purchases, demonstrating the region's sustained momentum in short-term rental investments.

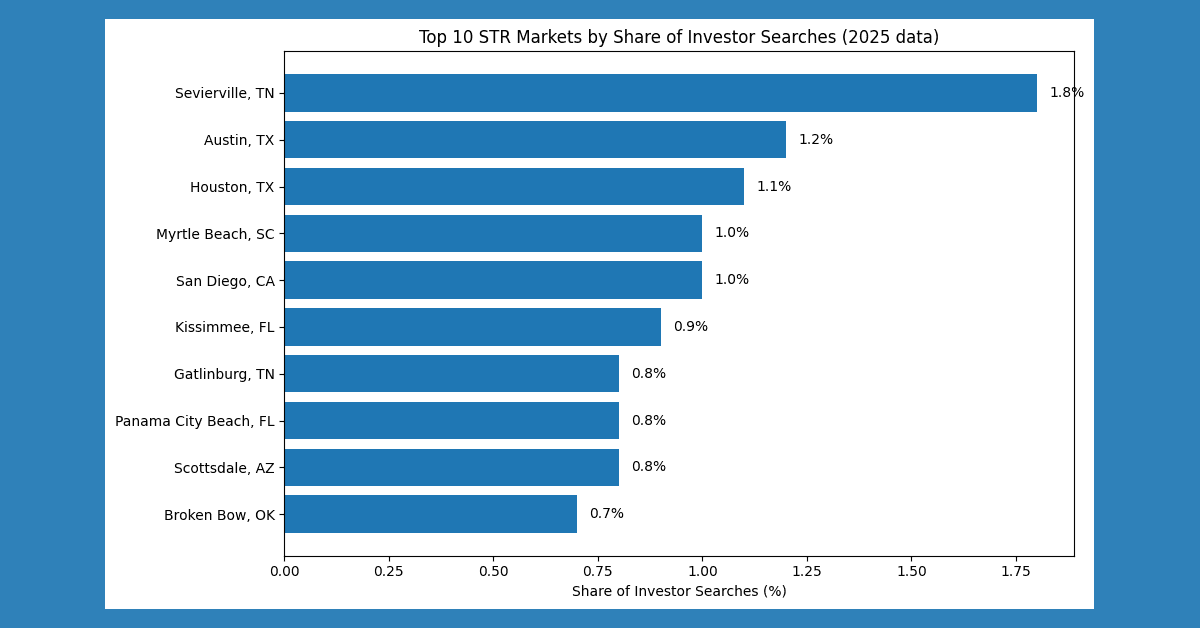

Regional markets significantly outshone major cities in 2025, with secondary "drive-to" vacation markets seeing higher engagement rates per listing than traditional urban hotspots. Chalet users closed 205% more short-term rental property deals in 2025 than the previous year, yet big city markets accounted for only 27.3% of all closed deals. Sevierville, Tennessee, a gateway to the Smoky Mountains, ranked as the most-searched city on the platform with 1.8% of total searches, outperforming major urban centers like Austin, Texas (1.2%), Houston, Texas (1.1%), and San Diego, California (1.0%).

Nearly 70% of the 30 most-searched short-term rental markets in 2025 were regional or destination-driven markets rather than large urban metros, and approximately 73% of Chalet-assisted deals closed in regional markets. This pattern suggests investors are expanding beyond traditional markets to hunt for opportunities in regional destinations where traveler demand remains strong and competition may be lighter. The full 2025 analysis provides detailed insights into these shifting market dynamics.

Despite the concentration of searches in Sun Belt states, market interest remained broadly distributed across numerous locations. The most-searched individual market accounted for only about 1.8% of total searches, underscoring how widely distributed and fragmented market interest was throughout 2025. This distribution pattern highlights that while execution remains selective, research continues to be broad, creating a gap between where market searches occur and where transactions ultimately close.

Strict regulatory environments significantly suppressed market interest in 2025. Interest in regulation-heavy metros like New York City and Los Angeles was negligible, accounting for under 0.2% of all searches. Despite being large tourism markets, these cities attracted minimal attention within the broader search dataset, reflecting how restrictive regulatory frameworks limit short-term rental viability. In contrast, markets characterized by more stable and host-friendly policies consistently drew higher levels of engagement.

Austin, Texas emerged as the single most active market for closed deals, accounting for just over 9% of all transactions. A second tier of markets, including San Diego, California; Fort Lauderdale, Florida; Dallas, Texas; Kissimmee, Florida; and Myrtle Beach, South Carolina, each represented roughly 6% of closed deals. Beyond these leaders, the remaining transactions were spread across a long tail of secondary and regional markets, most contributing low-single-digit shares.

The data reveals that regulatory environment serves as a critical market filter alongside traditional performance metrics such as occupancy and yield. This pattern highlights the importance of inventory visibility, detailed ROI modeling, and market-level insights that help narrow a wide universe of opportunities into execution-ready decisions. Regularly monitoring market search behavior, apart from key Airbnb market metrics, is essential for staying ahead of emerging trends rather than reacting after capital has already moved.