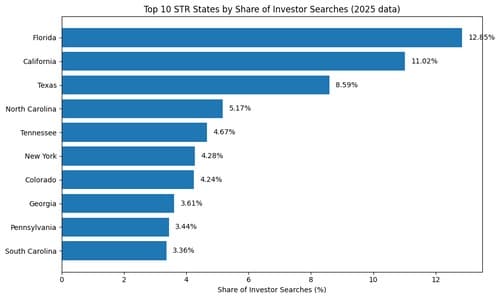

New data from real estate technology platform Chalet reveals that nearly one-third of all 2025 Airbnb market searches conducted by investors were concentrated in just three Sun Belt states. According to the platform's analysis, Florida, California, and Texas collectively accounted for 32.5% of investor search activity throughout the year, demonstrating the enduring appeal of these markets for short-term rental property investment.

The findings underscore the Sun Belt's sustained pull on investment capital within the rapidly evolving short-term rental sector. While major metropolitan areas often dominate real estate discussions, Chalet's data indicates that regional vacation markets actually saw higher engagement rates compared to major cities when it came to property investment searches. This suggests investors are looking beyond traditional urban centers to identify opportunities in destinations with established tourism appeal.

Perhaps most notably, the data reveals a remarkably distributed pattern of investor interest. Even the most-searched individual market accounted for only about 1.8% of total searches in 2025, indicating that no single location dominated investor attention. This widespread distribution points to a maturing market where investors are conducting thorough due diligence across numerous potential opportunities rather than flocking to a handful of trending destinations.

The implications for both current and prospective short-term rental investors are significant. The concentration in Sun Belt states confirms established patterns of tourism and investment flow, suggesting continued confidence in these regions' economic and demographic fundamentals. Meanwhile, the high engagement with regional vacation markets versus major cities may indicate shifting traveler preferences or perceived better value propositions in these areas. Investors can access free Airbnb market analytics and interactive performance data through platforms like Chalet to conduct their own analysis.

For the broader short-term rental industry, these patterns suggest several important trends. The distributed nature of search activity indicates that investment interest is becoming more sophisticated and geographically diverse, potentially leading to more balanced market development across regions. The Sun Belt's continued dominance reinforces the importance of climate, tourism infrastructure, and regulatory environments in attracting investment capital. As the industry evolves, data-driven platforms that provide transparent market insights without costs or paywalls, such as those offered by Chalet, will likely play an increasingly important role in investment decision-making.

The data also has implications for local economies in both dominant and emerging markets. Regions capturing investor attention may see increased property investment, potentially affecting housing markets and local regulations. The planned introduction of an AI Copilot in 2026 by platforms like Chalet could further democratize access to complex market analysis, potentially leveling the playing field for individual investors competing with institutional capital. As short-term rentals continue to represent a significant portion of the real estate investment landscape, understanding these search patterns provides valuable insight into where capital is flowing and why certain markets maintain their appeal year after year.